Get the free michigan tax exempt form

Show details

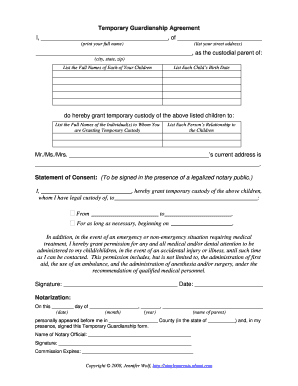

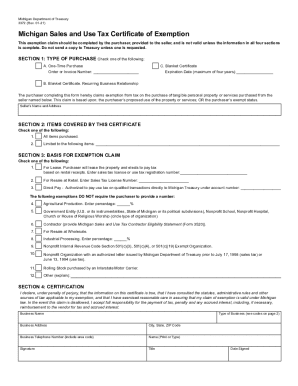

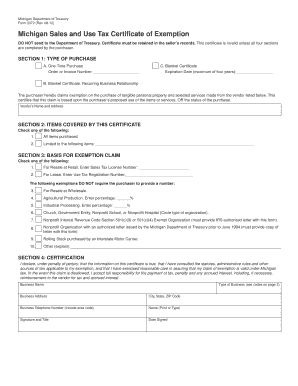

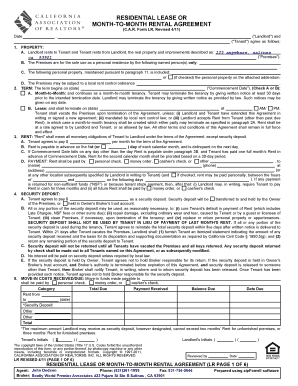

Reset Form Michigan Department of Treasury Form 3372 Rev. 11-09 Michigan Sales and Use Tax Certificate of Exemption DO NOT send to the Department of Treasury. Enter Use Tax Registration Number The following exemptions DO NOT require the purchaser to provide a number For Resale at wholesale Agricultural Production. Enter percentage Industrial Processing. Enter percentage Church Government Entity Nonprofit School or Nonprofit Hospital Circle type of organization Nonprofit Internal Revenue Code...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign michigan sales tax exemption form

Edit your tax exempt form michigan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your michigan tax exempt form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax exempt form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sales tax exemption form michigan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mi tax exempt form

How to fill out Michigan tax exempt form:

01

Determine if you qualify for tax exempt status in Michigan. This usually applies to certain organizations like nonprofits, religious institutions, and government entities.

02

Gather all necessary information and documentation, such as your organization's name, address, and federal tax identification number.

03

Download the Michigan tax exempt form from the official website or obtain a physical copy from the Michigan Department of Treasury.

04

Start by providing your organization's information in the designated section of the form, including its legal name, address, and tax identification number.

05

Indicate the type of organization you have (e.g., nonprofit, religious, government, etc.) and provide any additional details as required.

06

Clearly state the purpose and activities of your organization, including any services or goods it provides to the community.

07

Specify the types of sales or transactions that are exempt from Michigan sales tax and provide a detailed explanation for each.

08

If applicable, include any supporting documentation or attachments that prove your tax exempt status, such as articles of incorporation, bylaws, or religious affiliation proof.

09

Review the completed form to ensure all information is accurate and complete. Make sure to sign and date the form.

10

Submit the Michigan tax exempt form to the appropriate agency or department as instructed on the form or website.

Who needs Michigan tax exempt form:

01

Organizations that qualify for tax exempt status in Michigan, such as nonprofits, religious institutions, and government entities.

02

These organizations must meet specific eligibility criteria and provide the necessary documentation to support their tax exempt status.

03

By obtaining tax exempt status, organizations can avoid paying sales tax on certain purchases or transactions, which can help them save money and allocate resources more effectively.

Fill

michigan tax exempt form 2025

: Try Risk Free

People Also Ask about state of michigan tax exempt form

What is the tax exemption for 2023 in Michigan?

The personal exemption amount for 2023 is $5,400.

How do I get Michigan tax exempt status?

The Michigan Department of Treasury does not issue tax exempt numbers. In order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Michigan Sales and Use Tax Certificate of Exemption (Form 3372)

What is tax exempt form Michigan?

Form 3372, Michigan Sales and Use Tax Certificate of Exemption, is used to claim exemption from Michigan Sales and Use Tax. The buyer must present the seller with a completed form at the time of purchase.

What is the Michigan income tax exempt form?

You must submit a Michigan withholding exemption certificate (form MI-W4) to your employer on or before the date that employment begins. If you fail or refuse to submit this certificate, your employer must withhold tax from your compensation without allowance for any exemptions.

What is MI Form 165?

general Instructions – Annual Return (Form 165) filing requirements. You must file Form 165 if you are registered for sales tax, use tax, or income tax withholding in the State of Michigan. Monthly and quarterly filers must file Form 165 on a calendar- year basis (not your fiscal year).

What is the exemption for Michigan income tax in 2023?

The personal exemption amount for 2023 is $5,400.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit michigan resale certificate online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your tax exemption form michigan and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How can I edit mi sales tax exempt form on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing michigan tax exemption form, you can start right away.

How do I complete michigan sales and use tax certificate of exemption form 3372 on an Android device?

Complete mi sales tax exemption form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is tax exempt form Michigan?

The tax exempt form in Michigan is typically the Michigan Sales and Use Tax Certificate of Exemption (Form 3372), which allows eligible organizations to make purchases without paying sales tax.

Who is required to file tax exempt form Michigan?

Organizations that qualify for sales tax exemption, such as non-profit organizations, government entities, and certain educational institutions, need to file the tax exempt form in Michigan.

How to fill out tax exempt form Michigan?

To fill out the Michigan Sales and Use Tax Certificate of Exemption (Form 3372), you need to provide the name of the exempt organization, its address, the reason for exemption, and any relevant identification numbers, and then sign and date the form.

What is the purpose of tax exempt form Michigan?

The purpose of the tax exempt form in Michigan is to enable eligible organizations to make purchases without incurring sales tax, thus reducing their operating costs.

What information must be reported on tax exempt form Michigan?

The Michigan tax exempt form must report the organization's name, address, reason for exemption, tax identification numbers, and a signature of an authorized representative.

Fill out your michigan tax exempt form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Of Michigan Sales Tax Exemption Form is not the form you're looking for?Search for another form here.

Keywords relevant to form 3372 michigan

Related to form 3372

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.